hocus-focus/Getty Images

- The P/E ratio (price-to-earnings ratio) measures a company’s stock price in relation to its earnings per share.

- A low P/E ratio can indicate that a stock is undervalued, while a high P/E ratio can indicate that a stock is overvalued.

- A company’s P/E ratio mainly provides insight when compared to others in the same industry, or its sector overall.

- Visit Business Insider’s Investing Reference library for more stories.

When picking stocks to invest in, everyone always wants to get a good deal – companies that not only are worthwhile but are trading at a decent price. But how do you determine that decent price? It’s not necessarily a question of dollar amounts.

One time-honored tool for evaluating a stock – and the company behind it – is the price-to-earnings ratio, or P/E ratio for short.

The P/E ratio is a measure that allows investors to analyze the trading price of a stock’s shares, and to compare it to other companies’. In essence, it will tell you if the stock is trading at a sound investment level or at a speculative level.

How the P/E ratio works

Expressed as a single number, the price-to-earnings (P/E) ratio measures a company’s stock price in relation to its earnings per share (EPS).

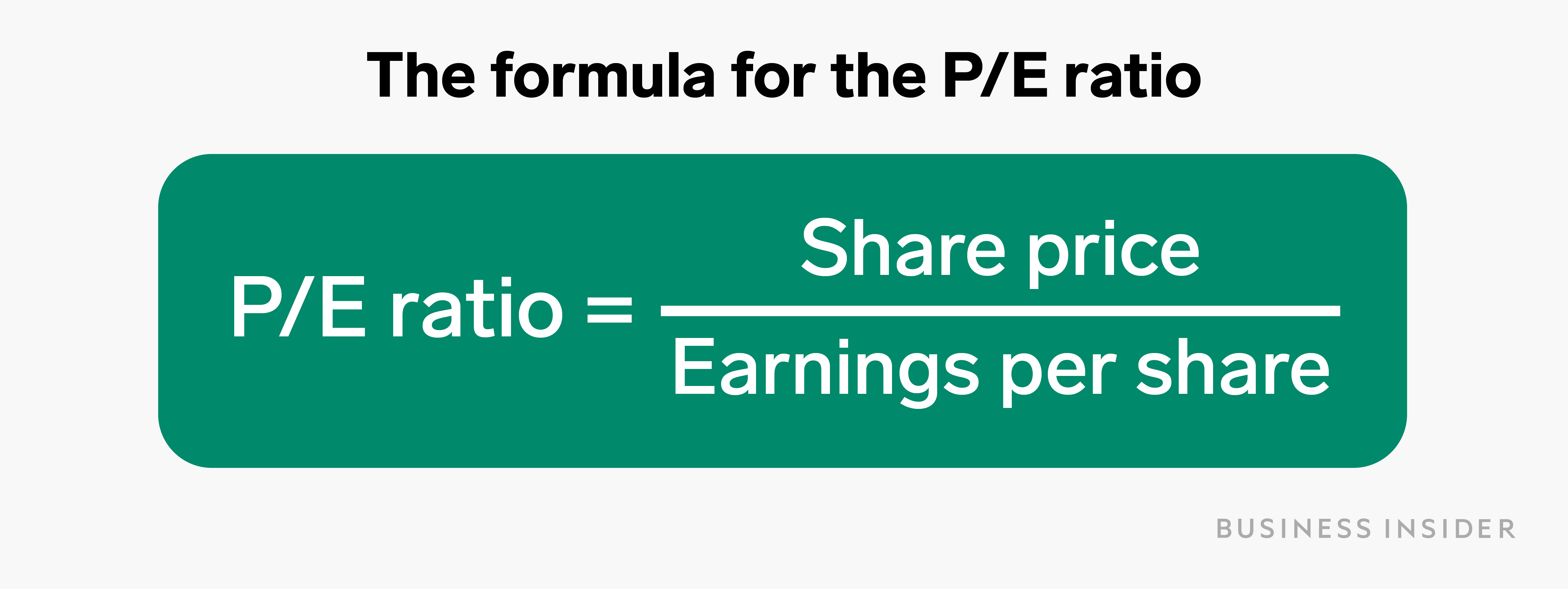

The P/E ratio, along with earnings per share, is usually indicated on a stock’s online listings page. But if you wanted to figure it yourself:

Yuqing Liu/Business Insider

The P/E ratio tells an investor how much hypothetically they are paying for $1 of a company's profits. So, for example, if the share price of a company is $50 and its EPS is $5, the P/E ratio would be 10. In effect, an investor would be willing to pay $10 for $1 of a company's earnings if they purchased the stock.

Now, if another company in the same industry also has a share price of $50 but an EPS of $20, its P/E ratio would be 2.5, meaning it would cost $2.5 to purchase $1 of that company's earnings. The second company is the better value, in theory, if all other variables are equal.

The significance of the P/E ratio

The P/E ratio is a large component of value investing, a strategy that seeks out companies whose stocks appear to be trading below their fundamental worth.

In general, a low P/E ratio can indicate that a stock is undervalued or that it is performing well, while a high P/E ratio can indicate that a stock is overvalued or that investors expect its performance to improve in the future.

The P/E ratio can be used to evaluate a company on its own, in comparison to other companies, or to a benchmark.

For example, if an investor is deciding between investing in a single stock or an exchange-traded fund that tracks the S&P 500, an investor can weigh the P/E ratios of both the company and the S&P 500 itself to see which is a better value.

Historically, the average P/E for the S&P 500 has ranged from 13 to 15. In May 2020, it rose above 20, its highest valuation in 18 years.

Comparing P/E ratios

So what's a high and low P/E ratio? Alas, there's no one answer. It all depends on the type of company you're dealing with.

When comparing P/E ratios of two stocks, it is essential to compare companies in the same industry. That's because each sector and industry will have its own P/E ratio, which will be the average of the P/E ratios of the companies in that specific sector or industry.

For example, the P/E ratio of the healthcare sector has ranged between 20-30 from 2018 to 2020. The financial services sector's P/E ratio has ranged between 6.5-10 for the same time frame.

The disparity comes about because different industries have different characteristics. For example, the capital expenditures of an airline company are higher than that of a technology firm and so it will have completely different debt levels and profits, and therefore ratios.

So, the P/E ratio really only provides insight when it is compared to other companies in the same industry - or to the average of the sector overall. "Every industry is going to have its own best ratios," says Evan Fisher, CEO at Unicorn Business Plans, which creates corporate models and plans.

That being said, "for certain industries, the P/E ratio applies much more as a relevant metric than for others," Fisher adds. "Retail, consumer, manufacturing - things of that nature. Versus younger, high-growth industries -for example, tech - where it may not be so relevant" because the firms have yet to post significant earnings.

The financial takeaway

A P/E ratio gives you insight into the current price of a stock: whether that stock is over or undervalued in relation to its peers and also to its own historical price. Focusing on fundamentals - a company's earnings per share - it blocks out external noise, like a market bubble that's pushing prices inordinately high, or panicky sell-offs, which is depressing them.

That said, the P/E ratio is only one source of information and it should be used to aid an analysis rather than as a sole point of data to rely on.

"It's not something we ever look at in isolation," Fisher says. "I would take the P/E ratio as one of the facets of the diamond that is the company. But you have to look at all the other facets as well, things like management effectiveness, future earnings forecasts, existing assets, positioning versus competitors, customer satisfaction."